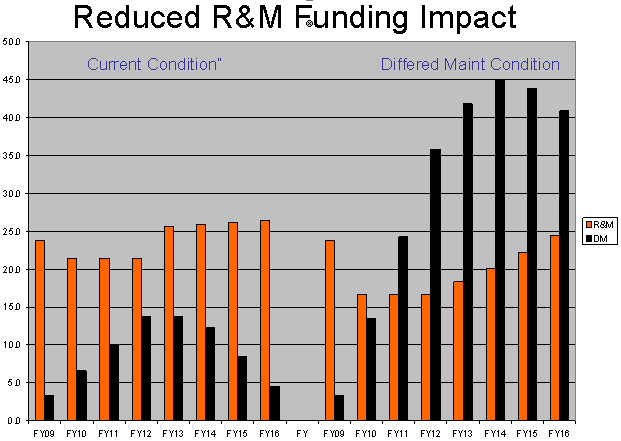

As budgets continue to be trimmed during difficult Pandemic times, your facility operating budget is often the targeted focus of multiple cost-cutting initiatives. Service levels associated with human capital and equipment maintenance are often modified downward, reducing frequency of service to achieve these cost reductions.

Capital and expense project funding is also historically cut back, often delaying significant repairs or replacement of aged and under-performing assets. These and similar reductions have an impact on your normal operating plan, which is meant to protect the company assets, ensuring that they reach or exceed their useful life expectancy. These cuts will also impact daily operations by reducing the dependability of critical assets.

Not only does funding a reasonable maintenance budget become even more difficult, it becomes even harder to protect. Many executives turn to maintenance expense when economic times become difficult, because managers haven’t had the solid information and numbers to support their budget requests, making it an easy target. This gap of quantifiable information has been a genuine roadblock to protecting maintenance programs and budgets

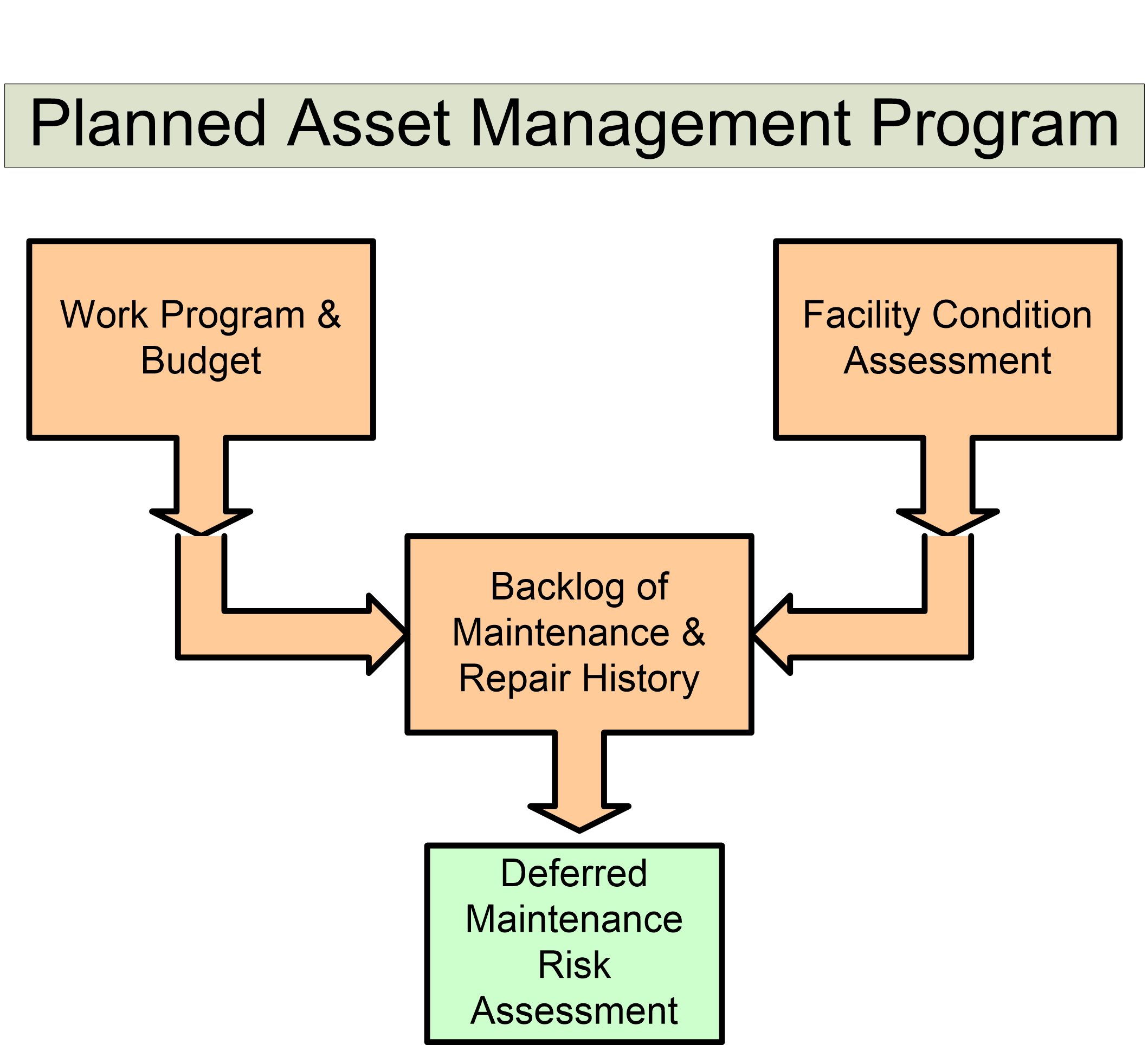

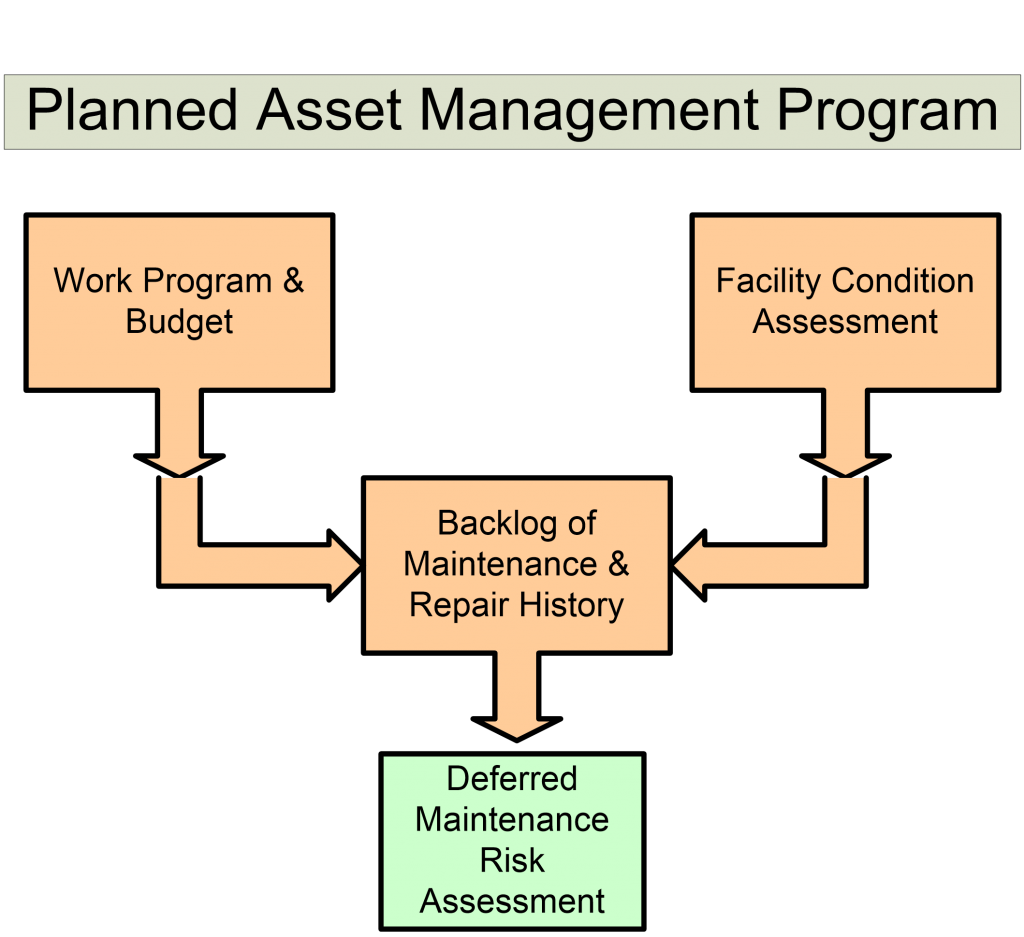

The question becomes, can you provide the right reporting to make informed business decisions about where to make service level adjustments and operating plan reductions? Will these cuts have short- and long-term impacts on the company’s financial performance due to unplanned premature failures and/or impacts to productivity? Tracking the Backlog of Maintenance and Repair (BMAR) history becomes a critical reporting requirement. A formal Work Program and BudgetTM (WP&B) along with a prescribed asset management

program can be the toolset to provide this level of reporting. However, a best-in-class application will utilize a fully Intergraded Maintenance Management System (IMMS) that combines and leverages the WP&B, facility condition assessments, and a planned asset management program. Do not confuse the IMMS with the CMMS one is a tool and the other a methodology.

When unplanned failures occur and/or economic times return to pre-covid conditions, this same reporting can be critical in helping to reinstate an appropriate operating budget. Additionally, this also allows you to know where to focus on rebuilding the short- and long-term capital/expense plan.

The reporting starts with a WP&B. This can be a simple spreadsheet or, better yet, tied to a computerized maintenance management system (CMMS). The intent is to document each physical piece of equipment associated with the facility, recording manufacturer information and age of the asset.

Next, we must identify the man-hours required to maintain the asset according to a specified service level. Finally, we calculate the annual materials, licensing, and component replacement costs required to keep each asset maintained at the identified service level. This interactive buildup of inventory, activities, man-hours, and budgets allows us to immediately see impacts of budget cuts on service levels.

A facility condition assessment (FCA) performed a minimum of every three years provides an asset performance benchmark. The facility condition assessment is a key component of the Integrated Maintenance Management System

(IMMS). The FCA will identify BMAR, provide a current evaluation of an asset’s current condition, and measure its performance against industry standards to determine the assets remaining useful life. This data then provides a detailed project list and planned operating expense plan looking out as far as five to ten years.

Utilizing the continuous feedback from the day-to-day execution of the workload, BMAR history, current service levels, aging, and even possible failure history, the IMMS must be updated frequently throughout the year to accurately reflect current conditions and needs. It is also a practical tool to track historical replacement and is crucial for reporting and rebuilding the capital plan.

The IMMS will provide the hard numbers executives need. It will demonstrate the dangers of deferred maintenance, and it will support the manager’s basic budget and the portfolio’s overall performance. So when cost reductions still have to be made, IMMS, WP&B, and the asset management program will provide the big picture information the manager needs to make well-informed, knowledgeable – rather than arbitrary – adjustments.

Your management reporting hierarchy then needs financial data presented in C-Suite terms to make sound decisions on where and what to eliminate. Preventive and predictive maintenance can often times actually reduce operating expenses when compared to a run-to-fail program. Therefore, we use the IMMS history and reporting to support financial justifications such as internal rate of return (IRR), return on investment (ROI), and cost of equipment failure to support your true budget needs and to make informed business decisions about specifically where to take cost reductions and what to defer for how long while limiting your risk of unplanned failures.